Investment, reimagined

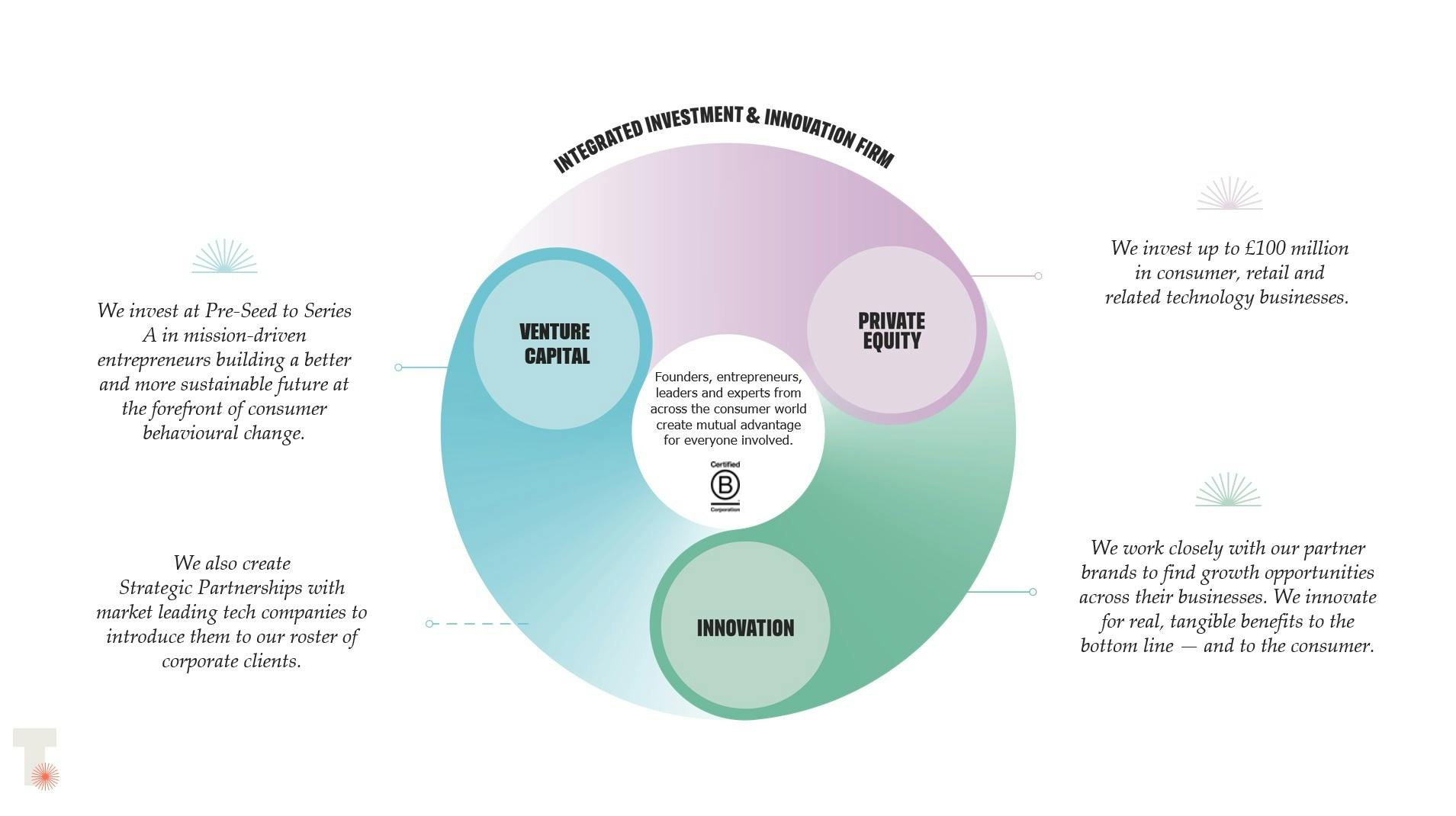

We have two funds - one private equity, one venture capital - dedicated to investing across the retail, consumer and technology ecosystem.

Private Equity Investments up to £100m

We invest across the retail, consumer and technology ecosystem including B2C, B2B and B2B2C. But investment is only one part of what we do for them. We nurture the businesses that we believe in, giving them everything from access to emerging technologies, to extraordinary collaboration opportunities from across our network to share best practice and create new ideas.

Venture Capital Initial Investments up to £2m

We back mission-driven entrepreneurs building a better and more sustainable future at the forefront of consumer behavioural and technological change.

Apply here

Office Hours

We are passionate about increasing access for underrepresented founders. Our Office Hours program provides an opportunity for you to explore whether venture funding is right for your business - get transparent feedback on your pitch deck, business model, and funding readiness from our venture capital team.

If you feel you lack the connections and context needed to secure VC funding, our team is keen to lend their experience in the industry and hear your story. If you’re a founder from an underrepresented background who lacks existing connections, we want to help open that door.

True Investment stories

Insight

Consumer is back — here's why and how

Consumer sector is experiencing a resurgence, and at the heart of the revival is AI. For investors, the convergence of profound consumer trends and the inflection point of AI-led innovation presents a unique opportunity to build massive value pools, reshape industries, and back the next generation of category-defining companies. Here’s why we at True are excited about the next few years.

News

The Cotswold Company opens its 13th showroom in Knutsford

The Cotswold Company has opened its very first showroom in the North West.