Venture Capital Initial Investments up to £2m

What we're looking for: Our Venture Capital Investment Thesis

We back mission-driven entrepreneurs building a better and more sustainable future at the forefront of consumer behavioural and technological change.

Built on the strength of True's network and expertise, our focus includes B2C and B2B business models, across Consumer (Tech & Products), Retail Tech and Sustainability Tech.

Our early-stage VC fund focuses on Pre-Seed to Series A, investing up to £2m initially and reserving capital to re-invest in the most promising companies.

Apply here

Office Hours

We are passionate about increasing access for underrepresented founders. Our Office Hours program provides an opportunity for you to explore whether venture funding is right for your business - get transparent feedback on your pitch deck, business model, and funding readiness from our venture capital team.

If you feel you lack the connections and context needed to secure VC funding, our team is keen to lend their experience in the industry and hear your story. If you’re a founder from an underrepresented background who lacks existing connections, we want to help open that door.

True Investment stories

News

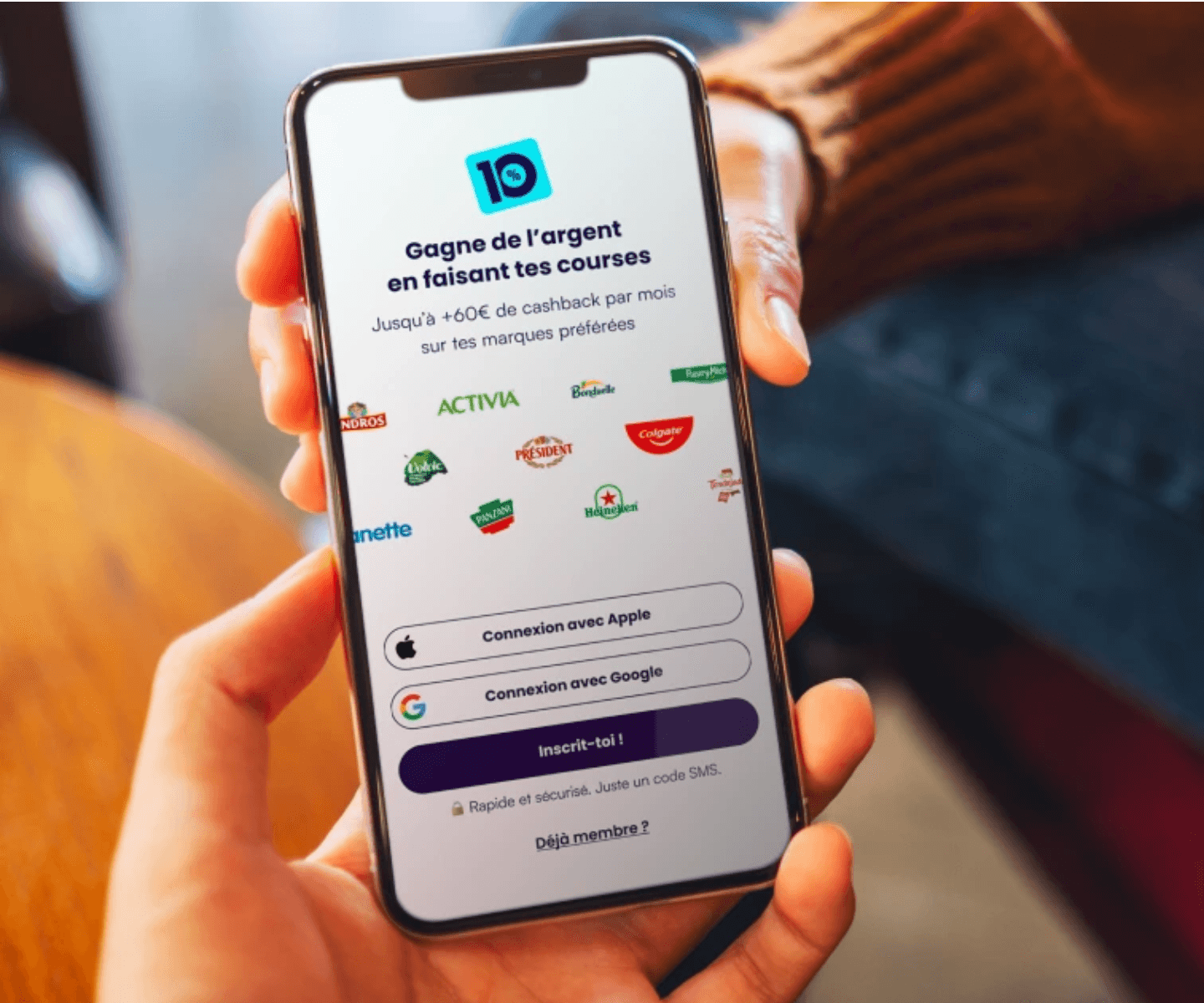

10% raises €2.4M to reinvent FMCG brand loyalty

We’re excited to announce our investment in 10%, a real-time data platform that removes intermediaries, enabling brands to collect, visualise and activate receipt-level data while rewarding users through a cashback app.

Insight

Consumer is back — here's why and how

Consumer sector is experiencing a resurgence, and at the heart of the revival is AI. For investors, the convergence of profound consumer trends and the inflection point of AI-led innovation presents a unique opportunity to build massive value pools, reshape industries, and back the next generation of category-defining companies. Here’s why we at True are excited about the next few years.